December 2013 San Diego Real Estate Market Update

Despite Annual End-Of-Year Slowdown, The National Real Estate Market Remains Strong

Although the end of the year typically brings a slight slowdown to home purchases as more consumers focus on the holidays and the coming new year, the United States real estate market is set to end the year exhibiting a very impressive annual rally. In 2013, double-digit gains were seen in the majority of the nation's tracked metropolitan communities, and the growing property market is expected to continue to see improvements throughout 2014.

This week, Bank of America Merrill Lynch released a comprehensive annual report outlining their predictions and expectations for the coming year. While many economists and experts have expressed concern over the Federal Reserve tapering down their quantitative easing program in 2014, the investment bank feels confident the coming twelve months will bring continued economic and housing growth.

To further illustrate the present strength and anticipated gains seen across the country, the Federal Housing Administration recently announced they will be making changes to the price-ceiling for sponsored loans in select markets. In areas that have seen a major rebound this year, the FHA will bwgin capping maximum loans at $625,000 instead of the current $729,750. Many view this as a sign that the organization, which currently holds a portfolio of around five million loans, sees the market as capable to stand on its own two feet without as much government intervention.

Lower Interest Rates Help Encourage Local Buyers To Act Faster

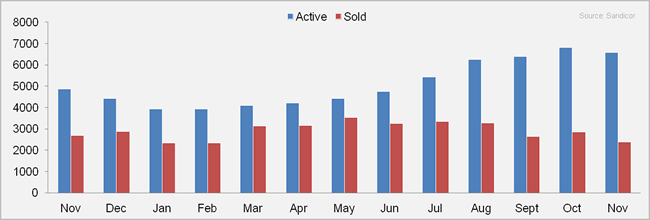

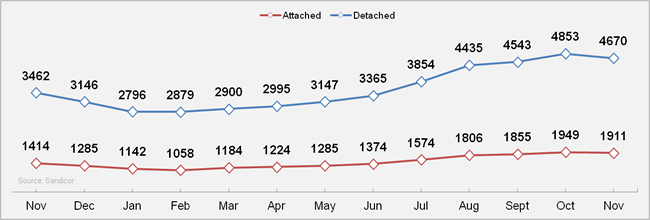

Throughout the San Diego real estate market, the signs of the typical year-end slow season remain very moderate. In November, the average number of active single-family listings dropped slightly from October's peak, but at 4,670, they still remain higher than any other month during 2013.

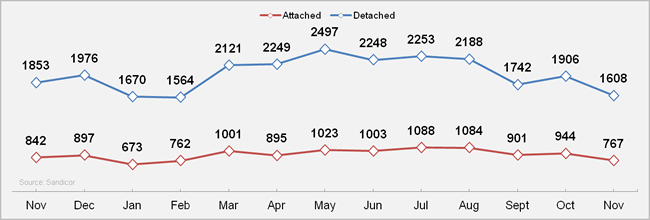

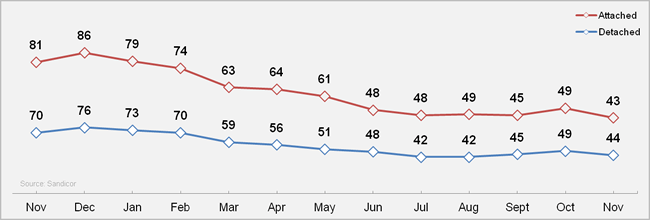

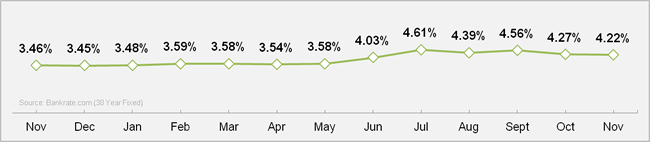

While the number of completed sales has also seasonally decreased, the rate at which qualified buyers are snatching up newly listed real estate has improved even further. In November, the average number of days on market for San Diego homes for sale dropped to a recently unprecedented 43 days. Some experts attribute this rapid pace of sales to dropping interest rates which averaged just 4.22% in November – down from the July high of 4.61%.

To convey how impressive this average number of days on market figure truly is, current results are even less than the timeframe for sales seen earlier this year when the market was making its largest strides. Year-over-year, the time it took an average home to sell in the month of November was nearly 50% less than what was in during the same period in 2012.

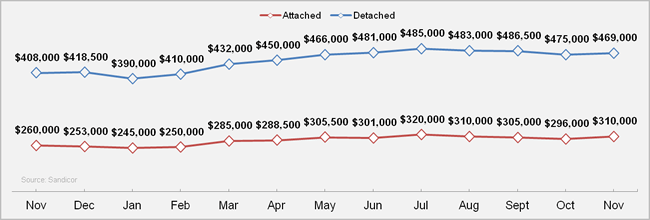

In November, the median sales price of single-family San Diego real estate experienced a decrease of 1.3% from the previous month, a number well within standard range of fluctuation during the holiday season. Overall, the past twelve months have brought a 15% median price gain across the board in San Diego County, with many well-desired communities seeing figures even higher. As 2013 comes to an end, there is no doubt that it will go down as one of the strongest for San Diego real estate in the past decade.

San Diego Recent Real Estate Market Sales & Statistics

Total Active & Sold Listings

Active Listings

Sold Listings

Average Days On Market

Median Price

Interest Rates

0 Comments

Comments