July 2013 San Diego Real Estate Market Update

Interest Rates Are On The Rise Across The Nation

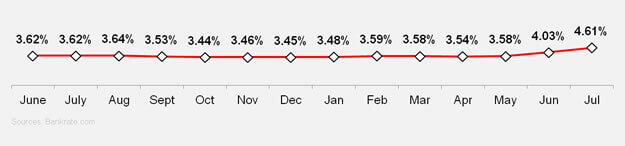

All over the United States, potential homebuyers have taken a hit as interest rates have continued to rise. During this past month, however, we saw the largest percentage jump in years. Last month's increase of the average 30-year mortgage rate by 0.45% was toppled by July's rise of 0.58%. Despite a two-month increase of over a full percentage point, buyers across the country are still out in force, taking advantage of rates still lower than historical averages.

In addition to average interest rates rising, foreclosures have been down across the nation this summer. June's number of foreclosure filings barely peaked over 125,000 – a figure which is 35% less than seen in June 2012. According to RealtyTrac, June's number is the lowest seen since December 2006, before the beginning of the major real estate downturn.

Despite fewer new foreclosures being initiated, the number of homes still in the foreclosure process remains relatively high. These properties are still causing major headaches for homeowners, some of whom have been battling the process for years, while other homes that lenders have already foreclosed on are still having a negative effect upon nationwide real estate prices.

San Diego Home Sales Cool Slightly As Inventory Levels Creep Up

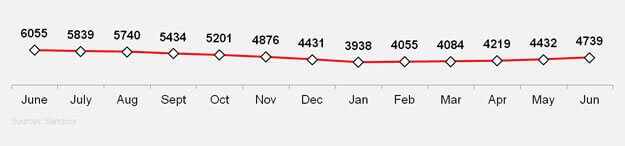

For the fifth straight month, the San Diego Association of Realtors reported an increase in the average inventory level throughout the county in June. Showing its biggest percentage gain since beginning to rebound in January, the number of San Diego homes for sale increased by 6.9% in June to an average of 4,749. Each month, it becomes evident that more and more home owners are finding the current seller's market the perfect opportunity to cash out some of the gains seen in local San Diego home values throughout this year.

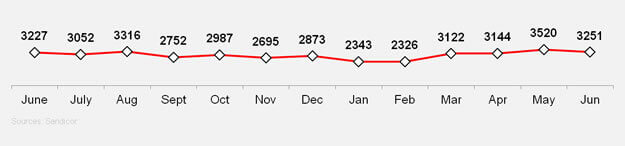

Another first in recent months for the local market is a slightly lower number of home sales completed. For the first time since February, the number of completed home sales fell from May's twelve-month high of 3,520 down to only 3,251 in the month of June – a figure still ahead of the number of sales in April.

Many local industry experts feel that the decrease is a result of the recently rising interest rates. It is also possible to expect sales to remain steady over the next month or so as interest prices rise and eventually stabilize. As interest rates begin to level again, buyers will become more accustomed to the slightly higher, but still historically low, rates and feel confident in making purchases once again.

Active Home Listings

The graph below shows the active number of homes for sale for the corresponding month.

Home Sales

This graph shows the number of closed sales for the corresponding month.

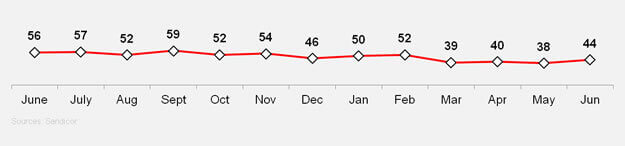

Absorption Rate

The absorption rate is the number of months it would take to sell all of the homes that are currently for sale if no new homes were to come on the market.

Interest Rates

Interest rates are based on 30 year fixed mortgage rates.

0 Comments

Comments