June 2013 San Diego Real Estate Market Update

National Housing Market Charging Ahead at Full Speed

During the first quarter of the year, the real estate market showed huge growth across the United States. The S&P/Price-Schiller index, a measure of the nation's residential real estate markets, rose 10.2% during this time – its fourth quarter of gains in a row, as well as the biggest increase seen since 2006. Other major markets in the country are following in Southern California's footsteps and seeing record-low levels of inventory, as well as high buyer demand.

In the United States, the inventory level is currently around 2.16 million properties – a number that is down 13.6% from just a year earlier. Part of the reason for this widespread lack of properties available to buyers is from the fact that nationally, the sales of distressed properties such as foreclosures are down 4% over the past year. Although they consisted of 45% of home sales in 2009, these sales presently make up only 21% of the real estate market. These properties often lower the value of the surrounding real estate by setting a low base value for neighborhoods. As the distressed properties market continues to shrink we should see further increases in property values as a result

The San Diego Real Estate Market is Still Booming

Across Southern California, home sales have been increasing at an enthusiastic pace. According to DataQuick numbers, May was the strongest month in the number of home sales for the southern part of the state since May 2006. Coupled with this increased number of sales, this means good things are still in store for the local marketplace.

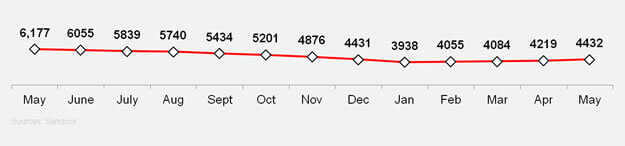

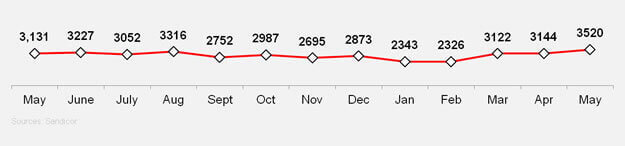

In San Diego real estate, the number of home sales jumped up from 3,144 in April to 3,520 in May – a boost of nearly 12%. Following a small increase between March and April, this shows that locally the market is still going strong. Impressive numbers were also seen in the number of active listings which increased by 5% to 4,432 this month.

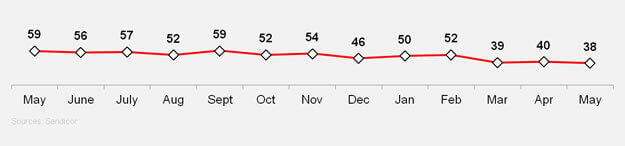

Despite the biggest jump we've seen since the number of listed properties reached its recent low in January, the increase in sold listing was large enough this past month to lower the area's absorption rate to only 38 days. This number has dropped over 35% in the past year from the 59 days of inventory seen in May 2012.

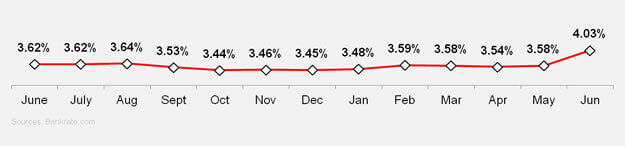

While May showed big increases for the San Diego real estate market, the recent half-point increase in average interest rates may show its affects over the next few months. After remaining around 3.5% for the past year, the average rate increased to just over 4% this month. Despite being bumped up over the past month, this is still historically a very low number and should not majorly affect home sales.

San Diego Real Estate Market Statistics

Active Home Listings

The graph below shows the active number of homes for sale for the corresponding month.

Home Sales

This graph shows the number of closed sales for the corresponding month.

Absorption Rate

The absorption rate is the number of months it would take to sell all of the homes that are currently for sale if no new homes were to come on the market.

Interest Rates

Interest rates are based on 30 year fixed mortgage rates.

0 Comments

Comments