What San Diego's Falling Number of Homes for Sale Means to You

Just a few years ago, southern California was considered one of the worst real estate markets in the nation. Plagued with over-development in the years leading up to the burst of the real estate bubble, countless newly-developed neighborhoods quickly became ghost towns thanks to waves of foreclosures.

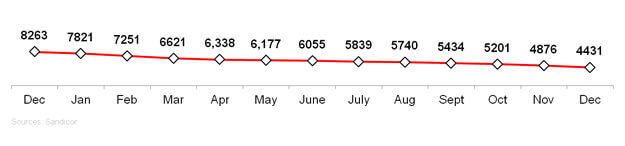

Fast-forward to today. By looking at the San Diego real estate market, it would be difficult for you to tell its recent troubled history. Statistics are showing that the southern California real estate economy is picking up at a rapid pace. The number of homes for sale in San Diego County as of the end of December 2012 was only 4,431! Comparing this to the 8,263 on the market one year prior will show that our area has seen an over 46% drop in available properties in just one year. Analyzing the market data over the year will show that the decrease has been a constant one from month-to-month.

What Does This Decrease Mean?

As we saw illustrated with the rising prices due to the increased demand present during a good portion of the previous decade, real estate prices are quite subject to the economic principal of supply and demand. When there is an increased amount of demand for a steady number of homes, competition will cause the prices of those homes to rise.

This economic formula not only works with rising demand, but also with decreasing supply. Since there are fewer and fewer homes for homebuyers to choose from each month, competition between the limited numbers of homes will increase, driving prices up the same way that we've seen in previous years. Thanks to economics basics, we can get a pretty good idea of where the market is going from here.

Even More Proof that the Market Is Recovering

Coupled with fewer homes available for buyers than we have seen in years, the San Diego area has also seen an increase in home sales during the past year. December 2012's 2,873 sales shows near a 7% increase in the number of purchases since 2011, all while inventory has dropped nearly in half!

According to nationwide analytics company, DataQuick, the number of defaults in San Diego County is also decreasing noticeably. The fourth quarter of 2012 brought only 2,655 notices of default (which is 44.8% less than the 4,813 during the same time period in 2011. Fewer homes are being put up for sale, the ones that are have become more likely to sell and less people are being foreclosed on and forced to move.

Be Ready

By understanding the data and visualizing what it is going to mean for the near future of the California real estate market, astute home buyers can take advantage of the window of opportunity we currently have. With all signs pointing towards home values increasing in the near future, someone who has been on the fence about purchasing for a while may become more motivated in order to take advantage of still-low prices which will probably not stick around for too much longer.

Home sellers are also able to use these statistics to their advantage. Many homeowners who have been trapped in underwater loans for a number of years now are beginning to see above the surface again. With home values preparing to increase, many residents will finally be able to get out of the home that has been causing them financial hardship for years. Clever homeowners should begin planning to take advantage of the increased demand by buyers to sell the homes that many Californians have had difficulty affording through the nation's recent economic climate.

No matter how you look at it, the real estate economy in San Diego County is looking up. Over the past year we have seen substantially less homes offered for sale, increased competition among those listed, a great number of properties being sold each month and fewer foreclosures. When presented with all of the data, it is easy to see what direction our market is taking. Begin planning for your real estate sales and purchases now in order to take advantage of the increase in San Diego home values that are on the horizon.

0 Comments

Comments