December 2012 San Diego Real Estate Market Update

While the national housing market is improving, there are still signs that indicate we are not yet experiencing a full-force recovery. Credit standards are still tight. There are millions of homeowners in some stage of foreclosure or default, while millions of others still owe more than their homes are worth. As long as the economy continues to strengthen, the housing market will move toward the recovery we have been waiting for. However until the recovery is fully realized, we must remain aware that if the economy weakens again, the housing market could relapse.

The Federal Housing Administration announced that as a result of so many mortgage delinquencies, it might have to exhaust its reserves, which could result in the FHA needing to rely on taxpayer funds for the first time in its 78-year history. A government bailout of this magnitude could possibly weaken the economy, but the U.S. Treasury will not make a decision until next February.

Considering the current, stringent mortgage underwriting standards, it’s important to know how credit scores work; improving your credit score will increase your likelihood of obtaining financing. NAR President Gary Thomas states, “Record-low mortgage interest rates shouldn’t be taken for granted.” Buying a home now is favorable for those that want to take advantage of interest rates while they are at historic lows.

Let's take a look at San Diego real estate statistics for the County:

Home Listings

The graph below shows the active number of homes for sale for the corresponding month.

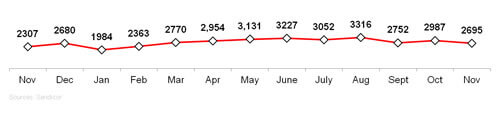

Home Sales

This graph shows the number of closed sales for the corresponding month.

Absorption Rate

The absorption rate is the number of months it would take to sell all of the homes that are currently for sale if no new homes came on the market.

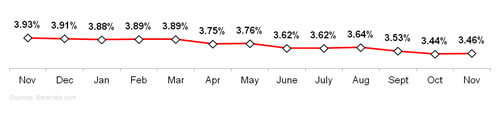

Interest Rates

Interest rates remain the lowest they have been in history and keep dropping.

0 Comments

Comments