January 2013 San Diego Real Estate Market Update

New Year, New Era for U.S. Housing Market

Moving into the New Year, it is widely recognized that the U.S. housing market is in full recovery mode. While there are still pockets of the country hit hard by distressed property sales, improvements are spreading from coast to coast.

Neither the presidential election or uncertainty over the fiscal cliff were able to de-rail the housing recovery suggesting that the U.S. should continue to see steady improvement throughout the 2013, with investment levels increasing dramatically according to new surveys.

Nationally, foreclosures remain high as a significant number of delinquent mortgages are worked through the system. However, lenders and servicers appear to have a firm grip on the throttle and continue to monitor the flow of distressed properties so as not to flood the market. Foreclosures are also increasingly being averted as mortgage lenders slash balances as part of settlements, non-performing loans are sold off and modified by new note holders and short sales continue.

In fact, the last minute fiscal cliff bill worked to preserve all of the crucial real estate related tax breaks including capital gains, mortgage insurance and the mortgage interest deduction as well as for businesses acquiring new property this year, restoring faith in the market, increasing the value of home ownership and making investment more attractive.

Spotlight on San Diego Real Estate

San Diego continues to be one of the healthiest and best performing real estate markets in the country with several housing and business trends likely to make it even stronger and more popular this year.

Speaking at a local conference this month, chief economist for Freddie Mac spoke out predicting continued growth in new housing starts in the range of 20-25%, and a particularly strong year for Southern California in terms of home sales and rising home prices.

Taking a look at the graphs below, all indicators are headed in the right direction. Inventory is declining, interest rates remain low to maintain affordability and home sales continue to rise.

In fact, the only thing we could use more of is inventory and more access to mortgage credit. The mortgage industry is healing but new rules take some time to work. New housing inventory will help provide fuel for growth, as will growing home values, which will encourage more to sell.

It still remains a very prudent time to capitalize on low home prices and mortgage rates before they head up. San Diego might be getting more expensive, but with around 30% to go before hitting the previous highs in home values before launching into new boom territory, there is a lot to be gained for those buying and investing in San Diego County right now.

San Diego Real Estate Market Statistics

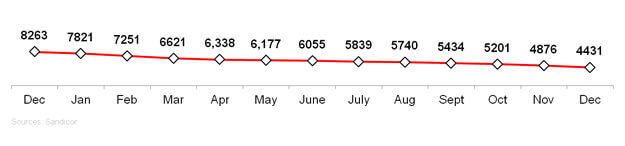

Home Listings

The graph below shows the active number of homes for sale for the corresponding month.

Home Sales

This graph shows the number of closed sales for the corresponding month.

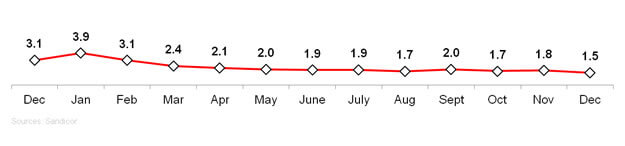

Absorption Rate

The absorption rate is the number of months it would take to sell all of the homes that are currently for sale if no new homes were to come on the market.

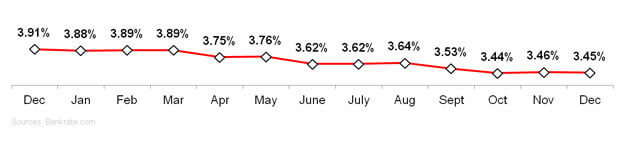

Interest Rates

Interest rates are based on 30 year fixed mortgage rates.

0 Comments

Comments