March 2013 San Diego Real Estate Market Update

US Housing Market Continuing to See Big Gains and Growth

The beginning of the year is off to a solid start for the US housing market. Numerous signs of growth across a myriad of different housing metrics show promise that the increase is likely to continue.

Federal jobs numbers released for February revealed that during the month employers created 48,000 new jobs in the construction industry. This is the largest amount of growth since March 2007, which was towards the end of the real estate bubble.

According to the Standard and Poors/Case Schiller Price Indices, which measure changes in the US real estate market across twenty metropolitan areas, the end of 2012 closed out with 6.8% year-over-year growth. That figure marks the highest amount of growth since July, 2006.

Recently, the National Association of Realtors released January data showing total US homes for sale at 1.74 million. This figure is down nearly 5% from the previous month, and signifies the lowest amount of homes on the market since December, 1999.

According to these numbers, builders are beginning to see the potential for profits thanks to an improving economy, demand for homes and fewer existing residences available for sale. This could mean an expected increase in prices in the near future thanks to optimal market conditions.

San Diego Real Estate Poised to Rise in 2013

Despite a few small decreases, which are common annually due to less activity in the housing market around the holidays, San Diego real estate is set to make healthy advances this year.

For the month of February, real estate analyst firm DataQuick recently revealed that the median home price in the San Diego area has risen nearly 3%, to $359,000. This increase follows a typical 4% decrease after the holiday season and restarts the constant growth seen through nearly all of 2012.

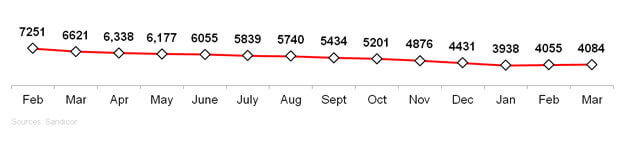

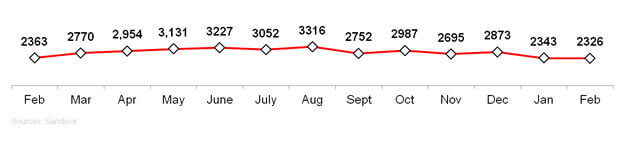

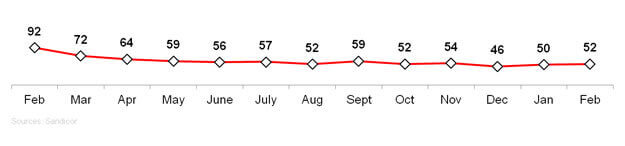

There has been a third month of increases in the number of San Diego homes for sale hitting the market in March, with the number increasing slightly over February figures to a total of 4084. Coupled with February's home sales of 2326, we see an absorption rate of 52 days in the area.

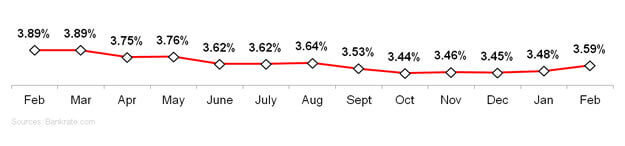

Interest rates rose again in February to 3.59%. This gain of .11% from January puts them at the highest levels since the 3.64% seen in August. This increase may also have a bearing on the slow beginning of the year in the market, and potentially a cause small lull next month depending on the continued direct of interest rates.

San Diego Market Statistics

Home Listings

The graph below shows the active number of homes for sale for the corresponding month.

Home Sales

This graph shows the number of closed sales for the corresponding month.

Absorption Rate

The absorption rate is the number of months it would take to sell all of the homes that are currently for sale if no new homes were to come on the market.

Interest Rates

Interest rates are based on 30 year fixed mortgage rates.

0 Comments

Comments